If you recently started shopping online, you must have encountered OTP and may wonder what it means.

A One-Time Password is a password that is valid for only one login session or transaction on a computer system or other digital device. It is typically used as an additional layer of security, especially in situations where traditional passwords may be vulnerable to theft or unauthorized access.

Keep reading to find out more about the OTP and its meaning in ecommerce.

Understanding OTP (One-Time Password) in Ecommerce Transactions

In ecommerce, OTP is a one-time password, a set of numbers or token codes that adds security to your purchase and package. It could be a set of numeric or alphanumeric strings of characters that grants a user access to a single transaction or login session.

It can be used during a 2-step authorization or as a standalone. Nowadays, it is almost impossible to go online shopping without OTP in Nigeria. Let’s see more about OTP code and find examples below to show how it works.

One time Password Examples

If you were to log in to your Google account on a new device, Google would request an OTP that starts with G- and the rest are numbers for verification. The same applies to some apps and websites. For example G- 22345.

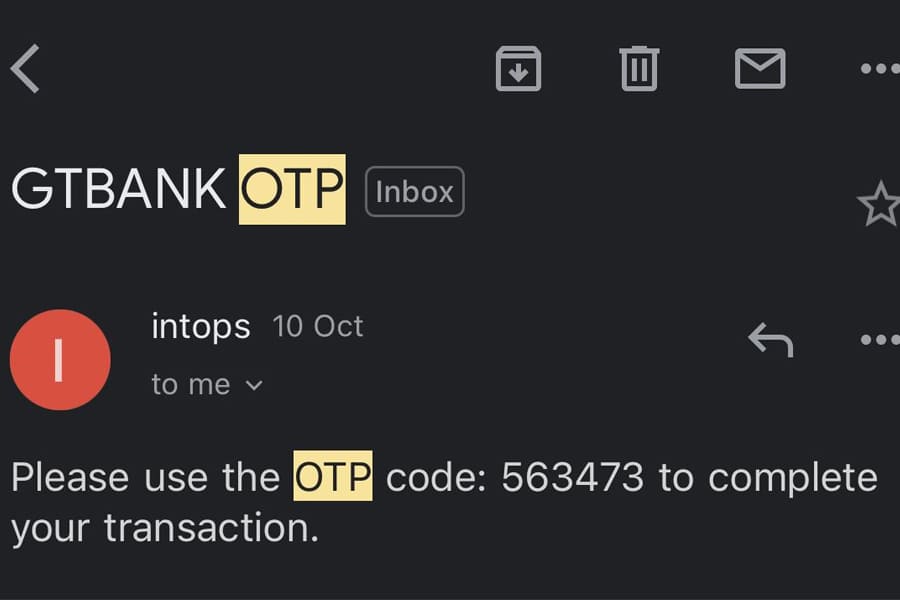

Another example would be if you are paying for an item online, you will need to provide your bank OTP, which will be sent to your email or phone number.

The Importance of OTP Verification in Nigerian Ecommerce: Ensuring Secure Online Transactions

With the increasing cybercrime and theft, the business must provide a strong OTP payment gateway that will be difficult for the user to bypass

OTP is commonly used in 2-Factor Authorisation (2FA), a 2-level security system that involves logging in with a password and receiving the OTP code on another device, email, or phone number for verification. This way, it is harder for fraudsters to purchase goods online with another card on a website. In Nigeria, both international and transactions require an OTP.

IT administrators and Ecommerce owners can also stop worrying about the common challenges with password security. They don’t need to worry about weak passwords and composition regulations such as one capital letter, alphabet, etc.

Users tend to repeat the same passwords over multiple platforms, but with OTP, it cannot be used more than once and expires within some minutes. Using an OTP at each delivery step relieves the business and the buyer.

How to Generate OTP for Your Ecommerce Transactions: A Step-by-Step Guide

Platforms like Grey co will always send you an OTP once you are about to log in, and the same applies to ecommerce stores.

From login to purchase, here is how to get an OTP code:

- Visit a site and log in with your email and password.

- The system will immediately request an OTP via SMS or email to your registered phone number. An OTP is usually time-bound (it can only be used within a period) or hash-bound, meaning it can only be used once.

- You have to enter the OTP to access the store. If the OTP is sent to your phone number and you can no longer access the SIM, accessing the store or website will be tough.

- Once you are in and are done selecting what you need, you will input your card details to make payment. During this stage, you will need another OTP (the bank OTP) sent by your bank as requested by the payment gateway, i.e., remit, Quick Teller, or Paystack.

- After providing the OTP, your purchase will be successful. It shows that you own the debit card and are authorized to purchase it.

When an unauthorized user tries to perform the transaction with your card details, they won’t be able to complete the transaction if they don’t have access to your Google account or SMS (Short Message Service).

Other methods of securing an e-commerce transaction include multi-factor authentication, biometric authentication, and secure socket layer (SSL) certificates.

OTP vs. PIN: Which is Better for Ecommerce Transactions?

A PIN (Personal Identification Number) is a numeric code similar to passwords but shorter. You can set a password to at least eight characters, but a PIN can be set to 4 digits.

An ecommerce store or payment gateway may allow you to use PIN, I.e., 3881, 4890, etc, instead of passwords for fast and secure checkout process. It is short and saves time. The good thing about PINs is they are hard to determine. However, most people use codes related to significant events like birthdays.

On the other hand, an OTP is generated by a computer, making it harder to determine. When it comes to security, an OTP may be the better choice, but when it comes to faster login, a PIN is better. You may be required to input your ATM PIN and an OTP when purchasing.

The Role of OTP in Mitigating Online Payment Frauds in Ecommerce

Recent reports show that multifactor authentication has blocked 99.9% of cyber attacks. Since OTP is one of the factors, it shows how important it is in mitigating online payment fraud. OTP codes are random and have no patterns, making it hard to decode or guess.

Since most websites use SMS OTP codes, you don’t need an internet connection to receive OTP, making it harder to crack. Also, you must input your password or bank code before receiving an OTP, making security tighter.

Common Issues with OTP Verification and How to Fix Them

Common issues when verifying OTP include poor connection, memory issues, and time-bound OTP not sending until the time expires.

There are several ways to solve them, including the following ones:

- Spam folder: if it is an Email OTP, you should immediately check your spam folder if you have not received it.

- Poor network: If you notice a poor connection, especially in the case of a time-bound OTP, you should switch your airplane mode on and off and restart your smartphone.

Last but not least, don’t forget to clear your messaging app cache. Sometimes, you do not receive an SMS OTP because your phone memory or the cache is full. So, you have to clear the cache to resolve the issue.

The Future of OTP in E-commerce: Opportunities and Challenges

The future of OTP in ecommerce looks promising as cybersecurity has become a serious career choice for youths. Aside from that, OTP is a cost-effective and convenient security measure. The opportunities include the growing number of internet users, ecommerce purchases, and the introduction of cloud-based OTP solutions and mobile applications. On the other hand, the challenges include not gaining access to your SIM cards due to misplacement or theft, poor network, and full memory.

Frequently Asked Questions

What does OTP mean when ordering?

An OTP is a one-time password generated automatically during payment or login to verify that a customer is authorized.

How do I get my OTP code?

You can get your OTP via SMS, email, in-app or phone. It’s up to the payment processor or gateway to decide how you get it.

What is an OTP code example?

An example of an OTP code is 55394, that will be sent to your email address or mobile number during a checkout or login session that you are trying to initiate.