International payment gateways in Nigeria, like Interswitch Webpay and Paystack, have grown immensely since the e-commerce boom in 2020. Additionally, This Day reported that online shoppers in Nigeria will rise to 122 million by 2025, making payment gateways in Nigeria a hot topic.

Since there are so many options for online payment gateways in Nigeria, it is wise to select only the best payment gateway for your business. This article will explore different international payment gateways in Nigeria and why they are essential for your ecommerce.

What Is an International Payment Gateway and How Does It Work?

An international payment gateway is an essential component of e-commerce that facilitates the payment of goods and services online. A payment gateway’s job is to accept customer debit or credit cards to pay for an item.

Think of them as portals like those in fictional movies, but they are digital and meant to help your business receive customer payments online. With an online payment gateway, you can send and receive payments via credit cards, digital wallets, and debit cards. Examples of international payment gateways in Nigeria include Paystack, GTPay, and Rave by Flutterwave.

How a Payment Gateway Works

Traditionally, terminals (POS) used magnetic strips and required customer signatures to accept credit card payments. Thanks to technological advancement, payment gateways now use chip technology to receive payments for goods and services.

The signature has been replaced by a personal identification number (PIN) and OTP (Time Password) entered into the payment gateway hardware (i.e., POS) or digital (GTPay), making payment contactless. A PIN is the code you enter at an ATM stand to withdraw money from a bank account.

Since the different international payment gateways in Nigeria have different architectures and fees, there is no one way a payment gateway works.

Popular International Payment Gateways Available in Nigeria

This section explores several payment gateways that allow ecommerce websites in Nigeria to accept payments locally and internationally.

Below, we will review the most popular payment gateways in Nigeria, so read on.

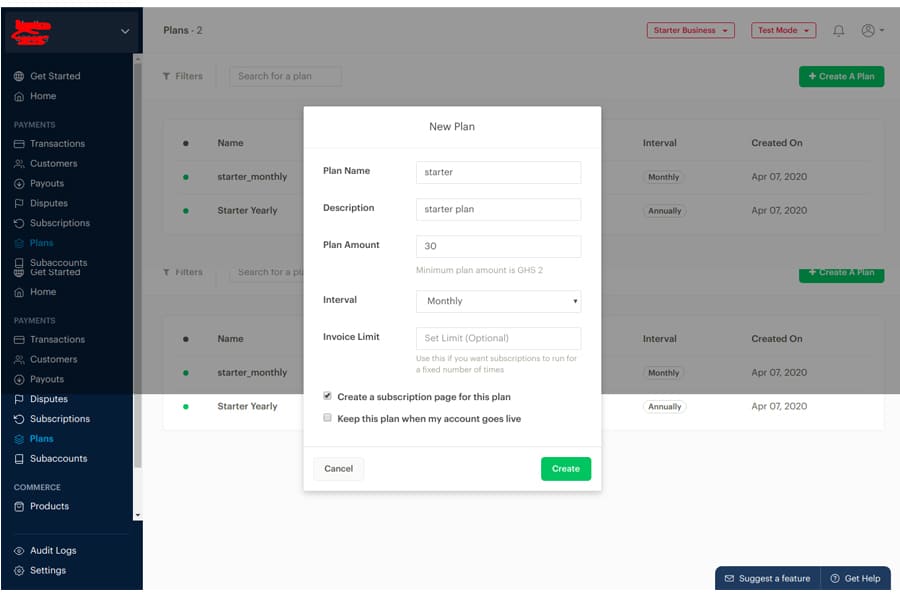

Paystack

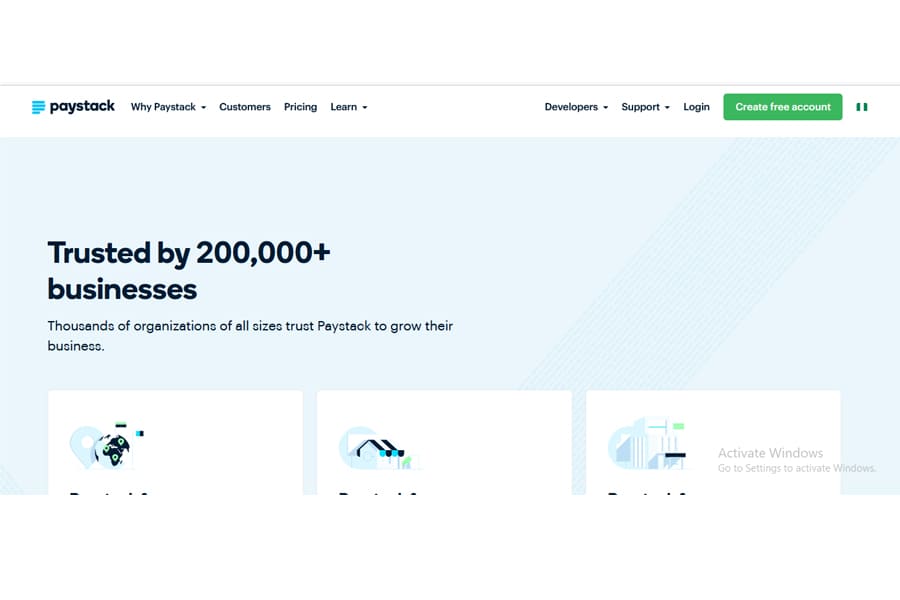

Shola Akinlade and Ezra Olubi founded Paystack, which was later acquired by Stripe in 2020. It is a payment gateway in Nigeria that has processed more than ₦10 billion in monthly transactions and is currently active in over eight countries. As a pioneer in the payment gateway space, Paystack is safe, secure, and easy to use. Now, it helps over 200,000 businesses to receive fast payments during transactions.

With its high success rate, Paystack makes a bold claim on its success rates page; “If a transaction fails on Paystack, it’s highly unlikely it’ll work anywhere else.”

With its high success rate, Paystack makes a bold claim on its success rates page; “If a transaction fails on Paystack, it’s highly unlikely it’ll work anywhere else.”

Below, we will review some of the Paystack benefits:

- Paystack is easy to use, and signing on to Paystack is free. Although it charges 1.5% + ₦100 for local transactions and 3.9% + ₦100 for international transactions, the ₦100 fee is waived for transactions less than NGN 2500. Paystack could also charge fees between ₦10 – 50 depending on the amount.

- Paystack boasts of a nearly 100% success rate. It’s one of Nigeria’s leading international payment gateways that promises and delivers secure transactions.

- Paystack ensures you receive payment the day after the transaction.

- Paystack is integrated with different popular ecommerce software;

Also, Paystack has several payment options like Card, Bank account, Apple Pay, USSD, Visa QR, Bank transfer, and Mobile money.

Flutterwave

Flutterwave is active in 30 countries and can process over 150 currencies. With over one million customers, including Uber, MTN, and PiggyVest, it serves a higher customer base than Paystack.

Flutterwave became a unicorn in 2021 when it raised $170 million in a Series C round.

Benefits of Flutterwave:

- Signing up for Flutterwave is free but costs 1.4% for local transactions and 3.8% for international transactions.

- Flutterwave ensures you receive payment within 24 hours after payment.

- Flutterwave uses different payment methods like: Mastercard, Bank Account, Bank Transfer, VISA, USSD, POS, and Visa QR for local transactions, and VISA, Mastercard, Verve, and AMEX for international transactions.

- Flutterwave offers recurrent billing for card payments.

In addition to that, Flutterwave is integrated into various ecommerce software like Joomla, WooCommerce, PrestaShop, and Ecwid.

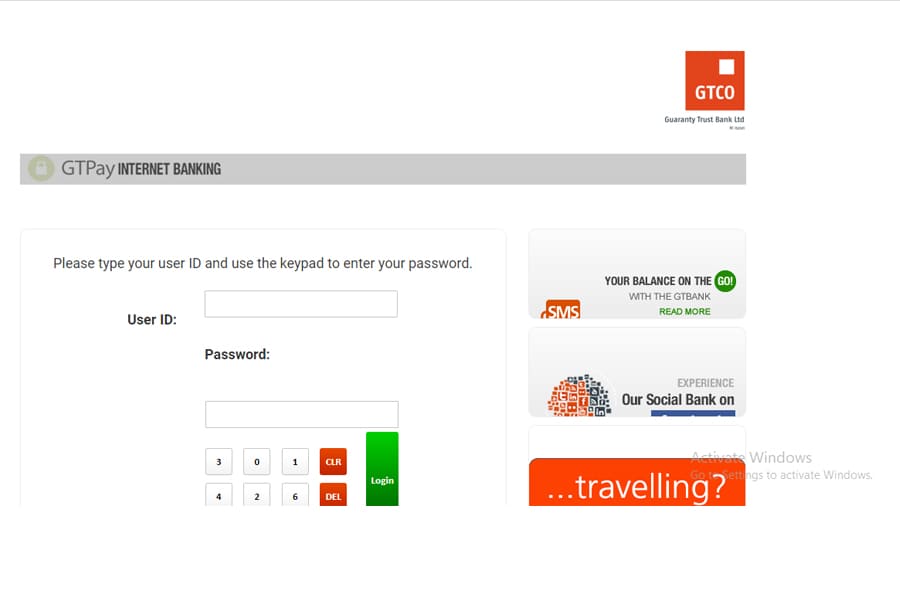

GTPay

GTPay is a secure and easy means of payment by GTBank to accept debit or credit card purchases from customers with their Visa or Master cards or cards issued by banks on the Interswitch Network.

As a customer, you should have a GTBank account to use GTPay.

Some of the features of GTPay are listed below:

- You need to pay a fee of ₦75,000 to set up GTPay. It costs 1.5% of the transaction amount for local Transactions and 3% for international transactions. It accepts both locally and internationally issued Interswitch cards, MasterCard and VISA. Additionally, GTPay takes a monthly charge of N5,000 for international transactions.

- GTPay ensures merchants receive payments within 24 hours for local and 48 hours for international transactions.

Last but not least, GTPay offers a unique monitoring log that enables merchants to view transactions as they occur.

Interswitch Webpay

Interswitch is the oldest payment gateway in Nigeria. Additionally, it created the Verve card, which is now a rival to Mastercard and Visa.

Amidst its success, it boasts big customers like Domino’s and BetKing.

Interswitch charges 1.5% for local transactions (capped at ₦2,000) and 3.8% for international transactions. However, it is free to sign up and set up. Users without an Interswitch account can accept payments via its payment link feature. Additionally, Interswitch can be used for recurring payments.

Also, Interswitch disburses payment to the merchant the following day of the transaction.

How To Choose the Right International Payment Gateway for Your Business

Before choosing a payment gateway, consider its features and ensure it will help you reach your business goals.

The following are factors to consider when selecting an international payment gateway in Nigeria:

- Business Goals: Your business needs and budget vary, so analyzing which payment gateway suits you best is best.

- Available Payment Methods and Currency Support: You should have researched your market to determine what payment methods are available to your customers. You need the payment gateway that supports your customer’s payment methods and currencies.

- Check Integration Compatibility: You should only select a payment gateway that is adaptable to your e-commerce store, CRM, or website.

Last but not least, consider the customer support carefully. Select a payment gateway with excellent customer service available 24/7 so customers can enquire during purchase if there is an issue.

Benefits and Challenges of Using an International Payment Gateway in Nigeria

International payment gateways give ecommerce businesses an opportunity on the global stage. With International payment gateways, you can sell to people beyond Nigeria. Regardless of whether it’s a small business, you can sell to people in the US and become recognized.

International payment gateways also support transactions in multiple currencies, allowing customers to choose which bank account they want for payment. For example, you can accept payment in euros from a customer based in the UK. This flexibility can boost international sales and increase conversion rates.

Another benefit that we can mention is that the customers can choose which payment option best guarantees a top-notch experience for themselves. For example, Flutterwave allows international customers to pay through VISA, Mastercard, Verve, and AMEX. Offering customers more choices is likely to convert them.

International payment gateways in Nigeria use encryption and tokenization to protect customers’ sensitive data. For example, customer’s credit or debit card details are usually encrypted during transmission. Also, some payment gateways can detect suspicious activity around customer accounts.

Still, we will mention some challenges that you and your business might face:

- Cross-border transactions: Sometimes, cross-border payments can be slow and expensive. For an e-commerce that depends on timely transactions, it could be frustrating. On the other hand, if a processing fee costs too much for customers, it is likely to deter them.

- Legal Issues: Cross-border payment in Nigeria involves some legalities involving two parties from multiple countries. What’s allowed in one country can be illegal in another, so payment gateways always have to worry about it.

- Tax Issues: Tax systems and charges cross-countries vary. Integration payments gateway already has a system to remove tax fees from the cost. However, it could be higher in some countries, making it difficult to convert customers with a product budget.

In addition to that, don’t forget the compliance Issues that you might encounter. Various compliance checks are involved in cross-border transactions. If compliance isn’t met, it could lead to a slow or declined transaction.

Security Measures To Take When Using an International Payment Gateway

International gateways must acquire the Payment Card Industry Data Security Standards (PCI DSS) certification before processing payments in any country.

The merchant must also comply with PCI DSS standards. Following this standard will protect cardholder data and build secure systems and networks.

How To Resolve Payment Gateway Issues in Nigeria

Some ways to resolve payment gateway issues in Nigeria, depending on the issue, is to inform customers to replace an order with a different card, use another browser, or contact their banks.

After trying these steps, and they are still unresolved, you can contact the support team of your international payment gateway. With customer support in place, you should discover and resolve the problem within a few hours.

Frequently Asked Questions

How can I receive international payments in Nigeria?

There are several ways to receive international payments in Nigeria: payment gateways, bank wire transfers, Payoneer, PayPal crypto, and ACH transfers.

Which payment gateway works in Nigeria?

These payment gateways work in Nigeria: Paystack, SeerBit, Interswitch Webpay, Remita, Flutterwave, and Monnify.

Which app can I use for international transfer from Nigeria?

There are many apps for this, but WorldRemit is a popular one. It’s a money transfer app that supports multi-currency and has no hidden costs. It is also available in more than 130 countries.